With Autobooks, you’ll be able to:

- Create professional invoices customized with your logo and branding.

- Easily collect payment or donations, in-person or online.

- Get paid directly into your secure checking account.

- Say, "Yes!" to customer requests to pay online with a card or bank transfer.

- Track invoice status and receive notifications when your invoices are viewed and paid.

- Never lose track of your money on a third-party app.

Your business demands a checking account that can keep up with your financial goals.

Meet our easy-way-to-do-business Business Checking account. With convenient features that make banking a pleasure, you’ll wonder how you ever ran your business without it.

Ask about our special products for IOTA and Public Funds customers.

Each checking account includes:

-

Online Banking with Bill Pay

-

Visa Debit Card with automatic fraud monitoring

-

Visa Debit Card with self-service fraud alters and controls

-

24-hour Automated Telephone Banking Service

-

Mobile Banking1 and Mobile Check Deposit2

-

Free access to more than 1,000 ATMs5

-

Notary Service6

Must be 18+ years of age.

1Mobile App required. Cell phone provider may charge additional fees for web browsing and/or text messages. In order to use Mobile Banking, the browser on your mobile device must be capable of storing cookies.

2Subject to eligibility. Deposits are subject to verification. Deposit limits and other restrictions apply. Must have the Mobile App downloaded to your smart phone. Must retain check for seven days prior to destroying it. Check images will not be available online, for copies contact Customer Engagement.

3Accounts will be charged the standard overdraft fee of $33 for handling each overdraft created by check, ACH, Point-of-Sale, ATM withdrawal, in-person withdrawal, or other electronic item that is paid and $33 for items returned. An overdrawn balance must be repaid within 32 days. We may not pay items under your Overdraft Privilege if you do not maintain your account in good standing by bringing your account to a positive balance within every 32-day period for a minimum of 24 hours, if you default on any loan or other obligation to Crews Bank & Trust or if your account is subject to any legal or administrative order or levy.

4Requires Visa Check Card. Some features require specific hardware and software.

5We have partnered with Allpoint and Presto to bring our customers access to a fee-free network of more than 50,000 ATMs. Simply go to our locations to locate the ATM nearest to you anytime you have the need for cash.

6Notary service is provided as a courtesy to our customers. Please call the office of your choice prior to your arrival to ensure availability. Please bring a photo ID with you. State laws require us to verify your identification, even if we know you. We are unable to notarize the following documents: wills, trusts, durable power of attorney, warranty deeds, quit claim deeds, or any certified copies such as birth certificates.

Additional documentation is necessary as required by federal law.

Overdraft Coverage

Life happens! We at Crews Bank & Trust understand that from time to time you may unexpectedly overdraft your account. Returned checks can be costly. Overdraft Coverage can help.

Let's talk!

We are here to help you and your organization.

SEE WHY LOCAL BUSINESSES CHOOSE TO WORK WITH US.

Dawn Marx, President of Buffalo Graffix

Blog

On Our Minds

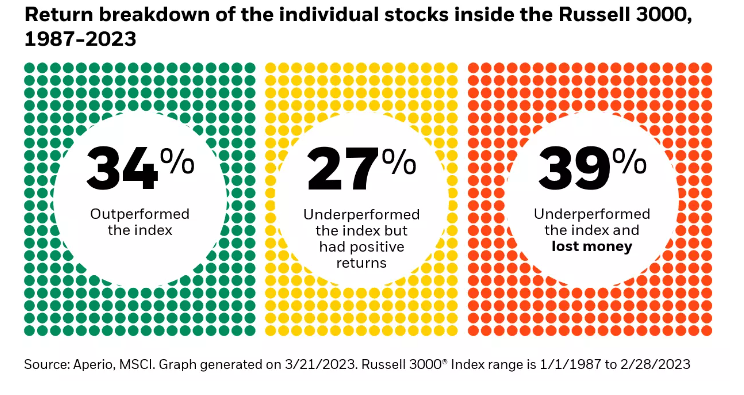

Chart of the Day: One Third

April 23, 2024

Today’s Chart of the Day from Aperio shows the percentage of individual stocks in the Russell 3000, which represents the 3,000 largest stocks in the...

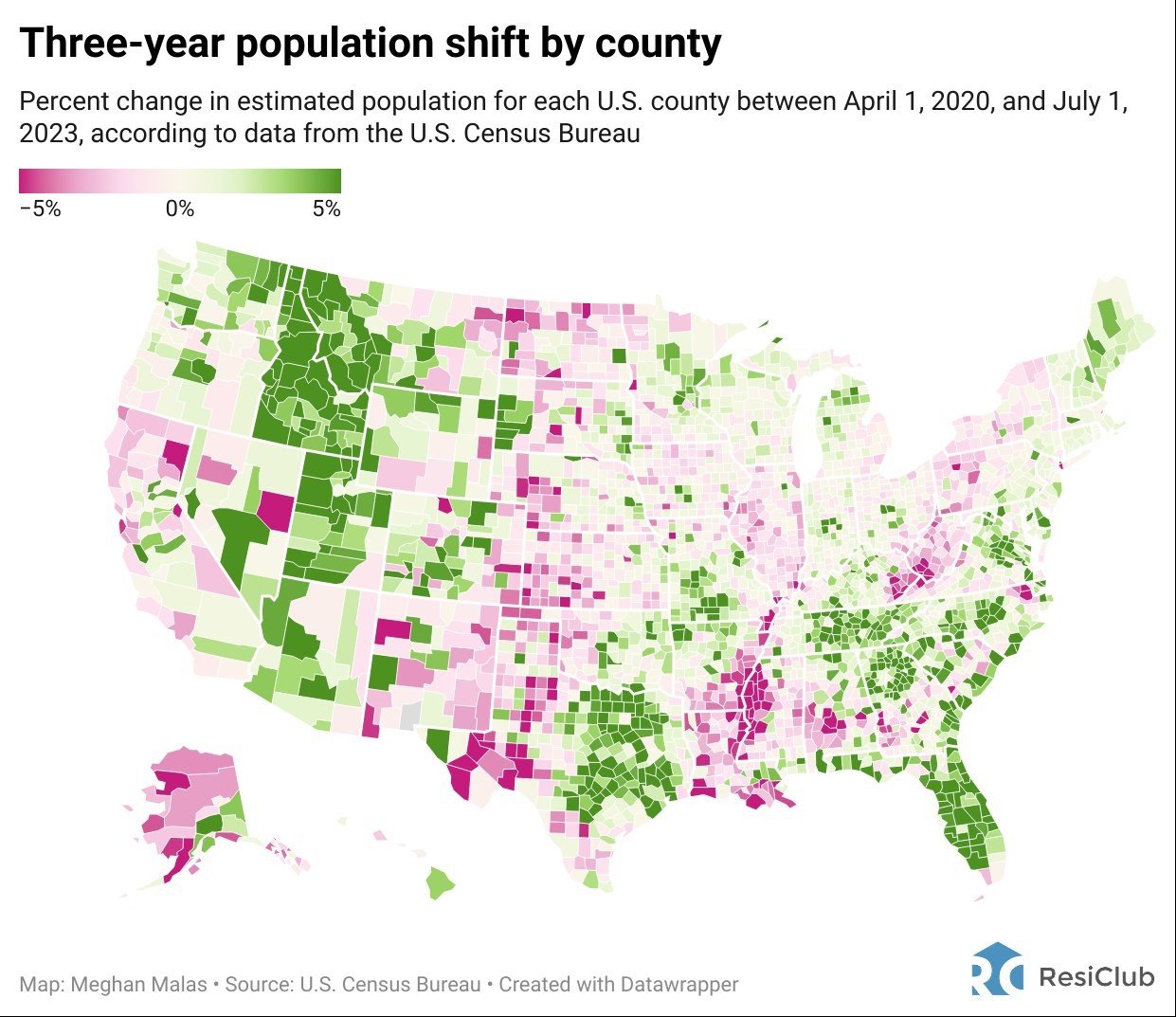

Chart of the Day: Population Shift

April 18, 2024

Today’s Chart of the Day is from Meghan Malas with data from the US Census Bureau.